In our previous blogs, we’ve explored:

- How much hydrogen you can produce using grid electricity alone while remaining compliant with the UK Low Carbon Hydrogen Standard (LCHS) – link

- How renewable PPAs can increase electrolyser utilisation without breaching carbon intensity limits – link

- How the price of your PPA directly impacts the final hydrogen cost, influencing both competitiveness and bankability – link

This time, we’re shifting the focus to a more commercial question:

How much PPA capacity should you secure if your goal is to minimise hydrogen cost — not just hit CO₂ compliance?

It’s a deceptively simple question, but one with major implications for project economics, power procurement, and offtake structuring. Size your PPA too small, and you risk high exposure to market prices. Size it too large, and you’re left with surplus energy that you might have to sell at a loss. The vice-versa applies and you might trade power for a profit. A perfectly sized PPA offers low-risk supply — but leaves some value off the table. So what’s an approach to risk that works for all parties and maximises the return on investment?

Hydrogen Offtake Agreements Are All About Risk Allocation

Hydrogen Offtake Agreements Are All About Risk Allocation

Every long-term hydrogen contract involves allocating risk — and the best contracts assign each type of risk to the party most capable of managing it.

Hydrogen Producers are typically able to:

- Hedge energy prices using long-term PPAs or forwards

- Optimise electrolyser dispatch based on market price signals

- Store hydrogen to smooth production

- Sell surplus PPA energy back to the grid

- Shift production to exploit price dips across the day-ahead, intraday, and imbalance markets

Hydrogen Offtakers, on the other hand, may be able to:

- Tolerate variable pricing, depending on how critical hydrogen is to their operations

- Accept reduced volumes or switch to a secondary fuel when necessary

- Operate with buffer storage for short-term supply smoothing

- Flex demand in certain processes or applications

A smart offtake structure balances these capabilities — locking in reliability where needed while unlocking value where possible.

What the Data Shows: PPA Size vs Hydrogen Cost

What the Data Shows: PPA Size vs Hydrogen Cost

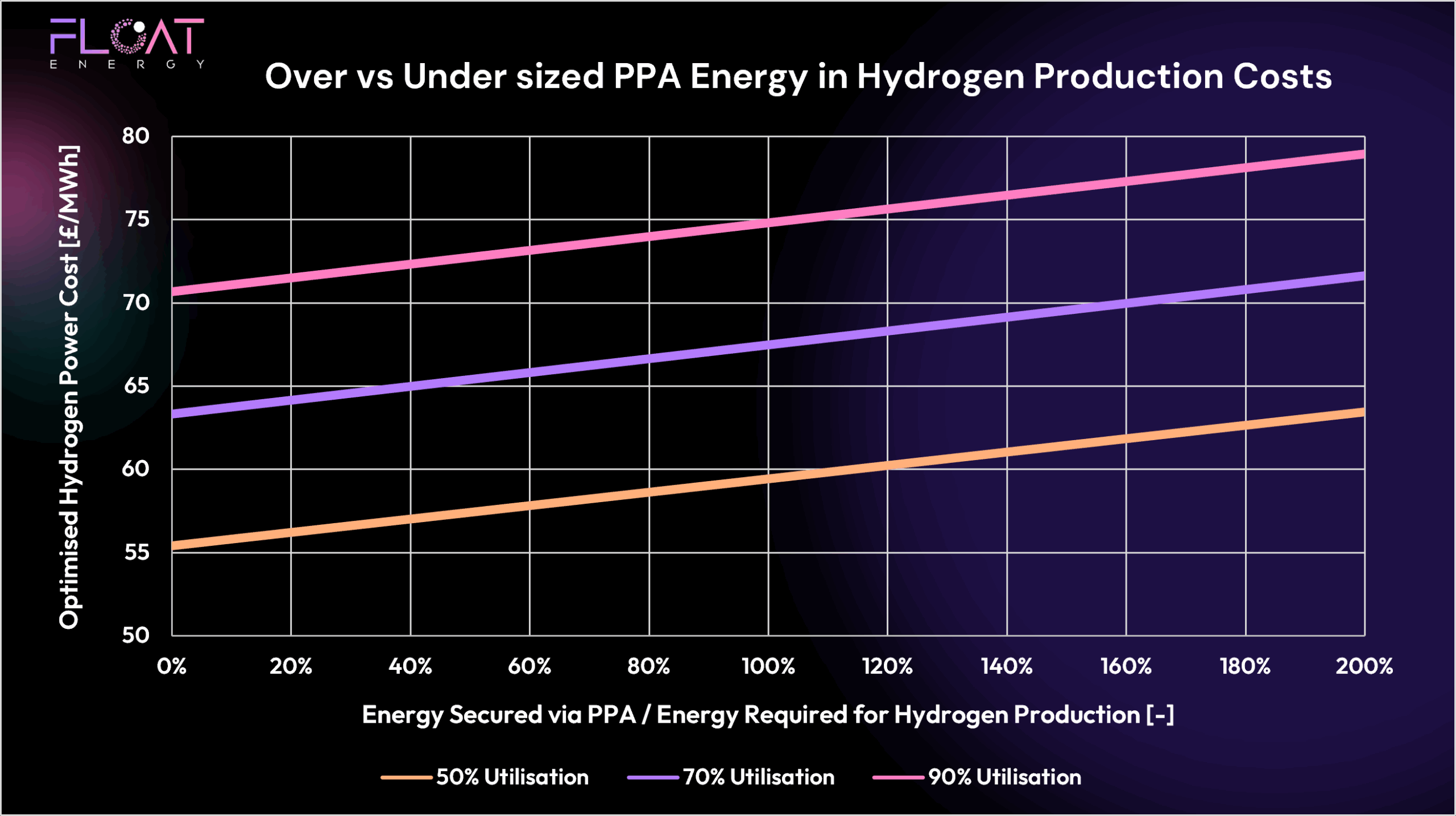

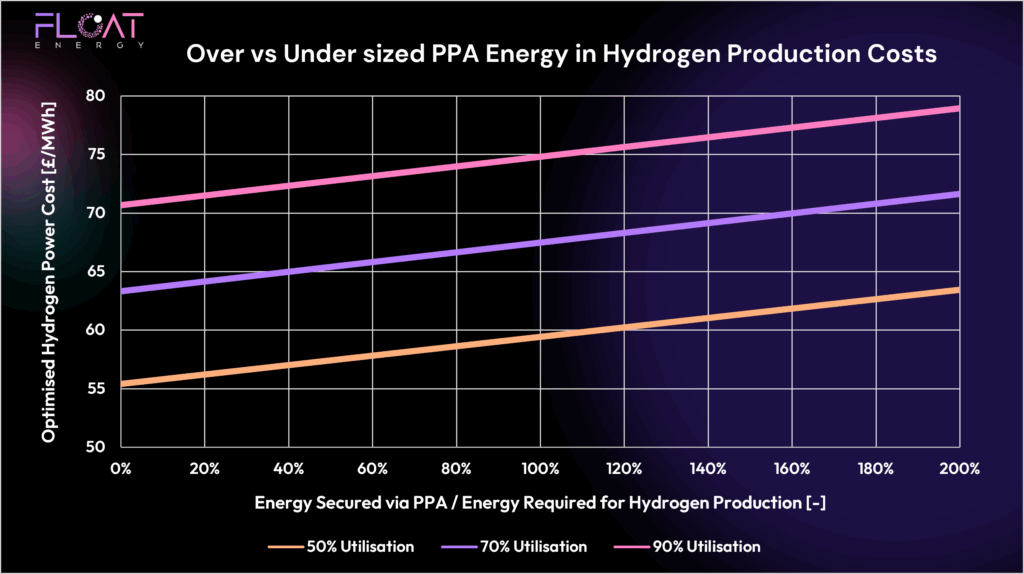

The chart below illustrates the relationship between PPA sizing and hydrogen power cost, based on 2024 electricity market conditions. The X-axis shows how much energy is secured via PPA relative to the energy required for hydrogen production. The Y-axis shows the resulting optimised hydrogen power cost in £/MWh.

Observations:

Perfect hedge (100%):

- When PPA energy matches electrolyser needs exactly, risk exposure is low as there is no need to purchase energy through wholesale markets.

Underhedging (<100%):

- Any shortfall must be bought from the wholesale market. In 2024’s calm market, wholesale prices were typically below the PPA price so this gave opportunity to reduce cost — but in volatile years, the risk would increase significantly.

Overhedging (>100%):

- Surplus energy must be sold back to the market. Because this often happens during low-price, high-renewables periods, you may end up recovering less than the PPA cost. For the 2024 prices modelled in the graph, we see that overall hydrogen production cost increased due to selling surplus power at a loss.

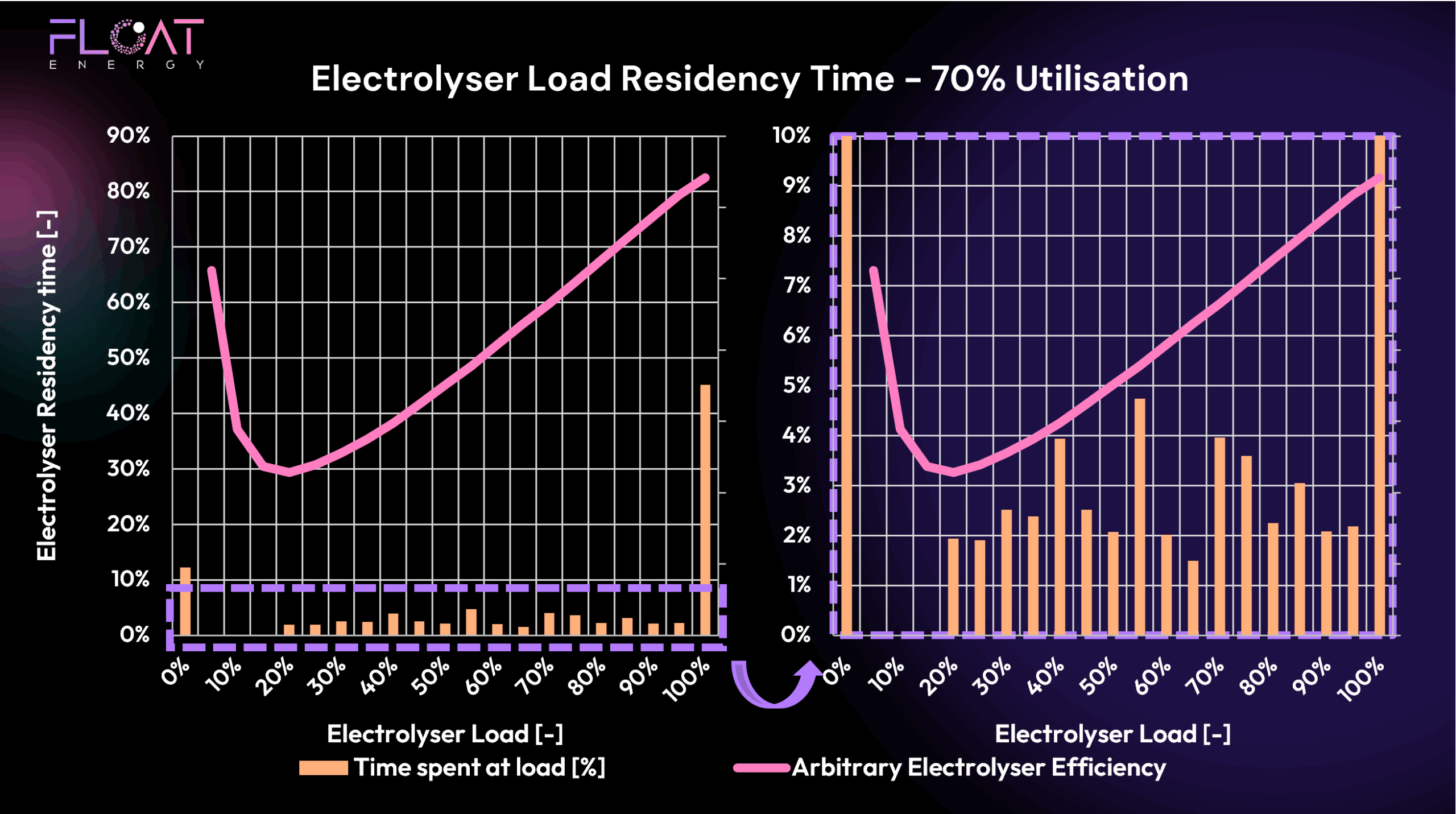

This illustrates a fundamental point: a PPA that doesn’t match your production exactly introduces market exposure — either on the buy or the sell side. Furthermore, we can’t control when the wind blows or sun shines. So even if you are perfectly hedged from a volume perspective, using an optimiser like FLOAT is still important to deliver that risk management in operations. For example, FLOAT’s real-time production scheduling will ensure your PPA generation, offtake and plant storage are all optimised for lowest cost!

Can Delivery Flexibility Act as a Synthetic Hedge?

Can Delivery Flexibility Act as a Synthetic Hedge?

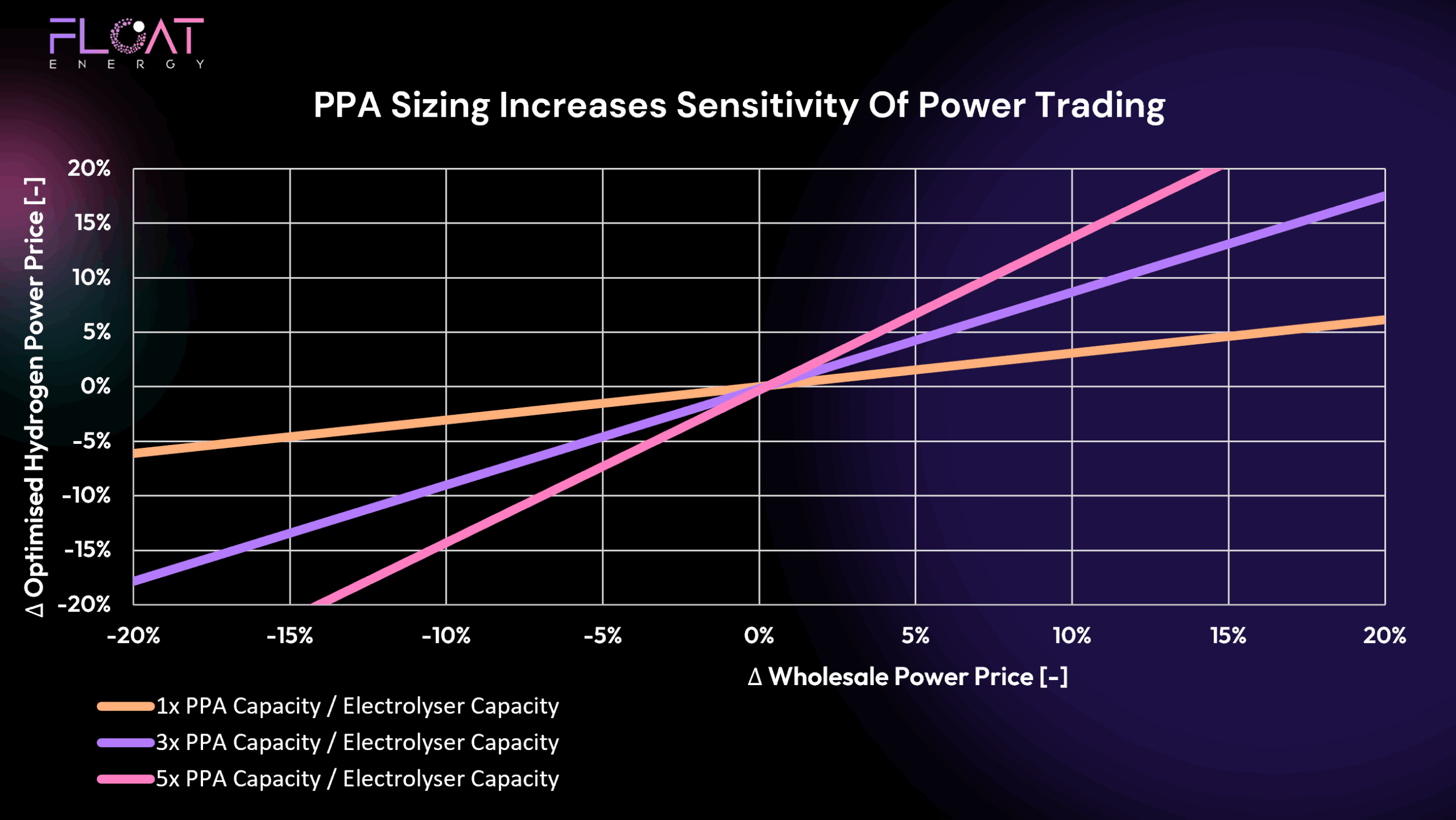

Some developers are exploring flexible offtake contracts that allow them to reduce hydrogen deliveries during high-price periods or when PPA energy falls short. This effectively allows the producer to:

- Avoid buying expensive market energy

- Size their PPA more conservatively

- Stay cost-optimal without full energy coverage

- Leave a shortfall in fixed price energy to enable potential upside with wholesale market trading

This strategy helps the producer maintain a form of synthetic hedge — reducing deliveries rather than incurring losses. But that comes at a cost:

- Producers gain: Optimised costs and lower energy exposure

- Offtakers lose: Less reliable supply, potential operational disruptions, or the need to dual-fuel or store backup

And the upside for the producer? In stable years like 2024, only a few £/MWh of savings. Is that worth the downstream disruption to the offtaker?

2024: A Calm Year — But Not a Predictable One

2024: A Calm Year — But Not a Predictable One

Importantly, 2024 was a relatively stable year in UK power markets — the first calm one since the 2021–22 volatility triggered by the Russia–Ukraine crisis and gas supply disruption. But market conditions will continue to evolve, with renewable penetration, weather variability, and interconnection constraints all playing a role.

That’s why relying on any single year’s data is risky. Smart developers use historical backtesting to understand the range of possible outcomes — and then build in flexibility to deal with future volatility.

Let FLOAT Model the Trade-offs — and Optimise in Real Time

Let FLOAT Model the Trade-offs — and Optimise in Real Time

At FLOAT, we help hydrogen developers make informed, data-backed decisions about PPA sizing, contract structure, and operational strategy:

During planning:

- Backtest different PPA sizes and offtake terms using real price data

- Model cost outcomes for under/overhedging scenarios

- Quantify the benefit (and risk) of delivery flexibility

- Factor in storage use, CO₂ compliance, and electrolyser degradation

Once operational:

- Use our optimiser to manage dispatch in real time

- Maximise value across various power markets

- Sell surplus energy, buy at the right times, and stay compliant with CO₂ rules in low carbon hydrogen standards (such as the UK LCHS)

- Ensure you’re not just minimising cost — you’re actively managing risk

Final Thought

PPA sizing isn’t just for achieving CO2 compliance or a bankable project — it’s a strategic lever that shapes your entire business case. A perfectly sized PPA might give you low risk and low cost in an excel spreadsheet — but in reality, a PPA paired with the right optimisation, trading and flexibility strategy, can unlock additional value.