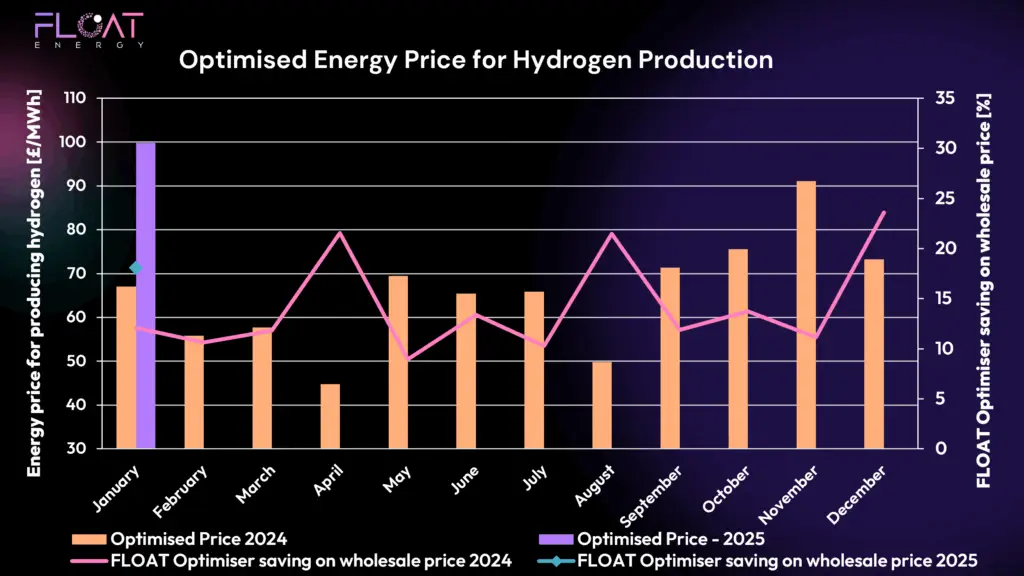

📊 Energy Cost Performance

Our optimiser successfully navigated January’s price extremes, delivering a £100/MWh average energy cost for hydrogen production — a notable rise from the 2024 average but reflective of the wider system conditions. This price demonstrates the optimiser’s ability to limit exposure, even in difficult markets. Without optimisation, producers exposed to wholesale markets would likely have faced significantly worse outcomes.

While January’s optimised price sits above 2024’s typical levels, it reinforces why real-time optimisation remains essential. Optimisation allowed FLOAT clients to remain flexible, opportunistically reducing costs where possible, and maintaining operational continuity when required.

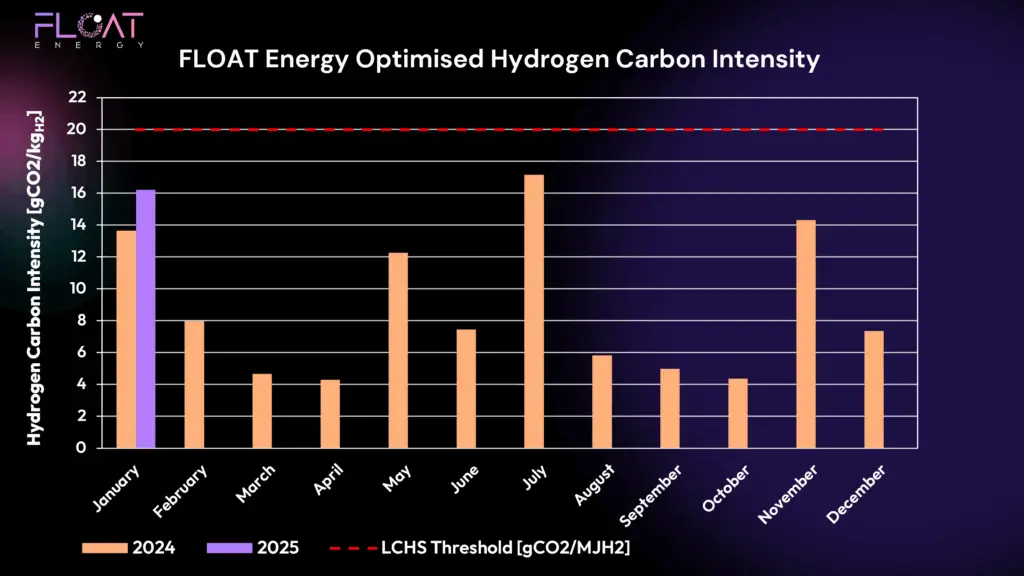

📉 Carbon Intensity Performance

The carbon intensity for January 2025 rose to 16 gCO₂/MJH2, up from 14 gCO₂/MJH2 in January 2024, but still comfortably below the 20 gCO₂/MJH2 LCHS threshold.

Why the increase? As grid carbon intensity rose during low renewable periods, the optimiser had fewer opportunities to chase ultra-low carbon windows. However, the optimiser still ensured that hydrogen production remained compliant, avoiding the need for costly PPAs purely for carbon purposes.

What This Means for Hydrogen Producers

January 2025 reaffirmed key lessons for hydrogen producers:

Volatility remains the norm.

Price spikes, supply shocks, and system tightness will continue to drive short-term costs. Optimisation is your best defence.

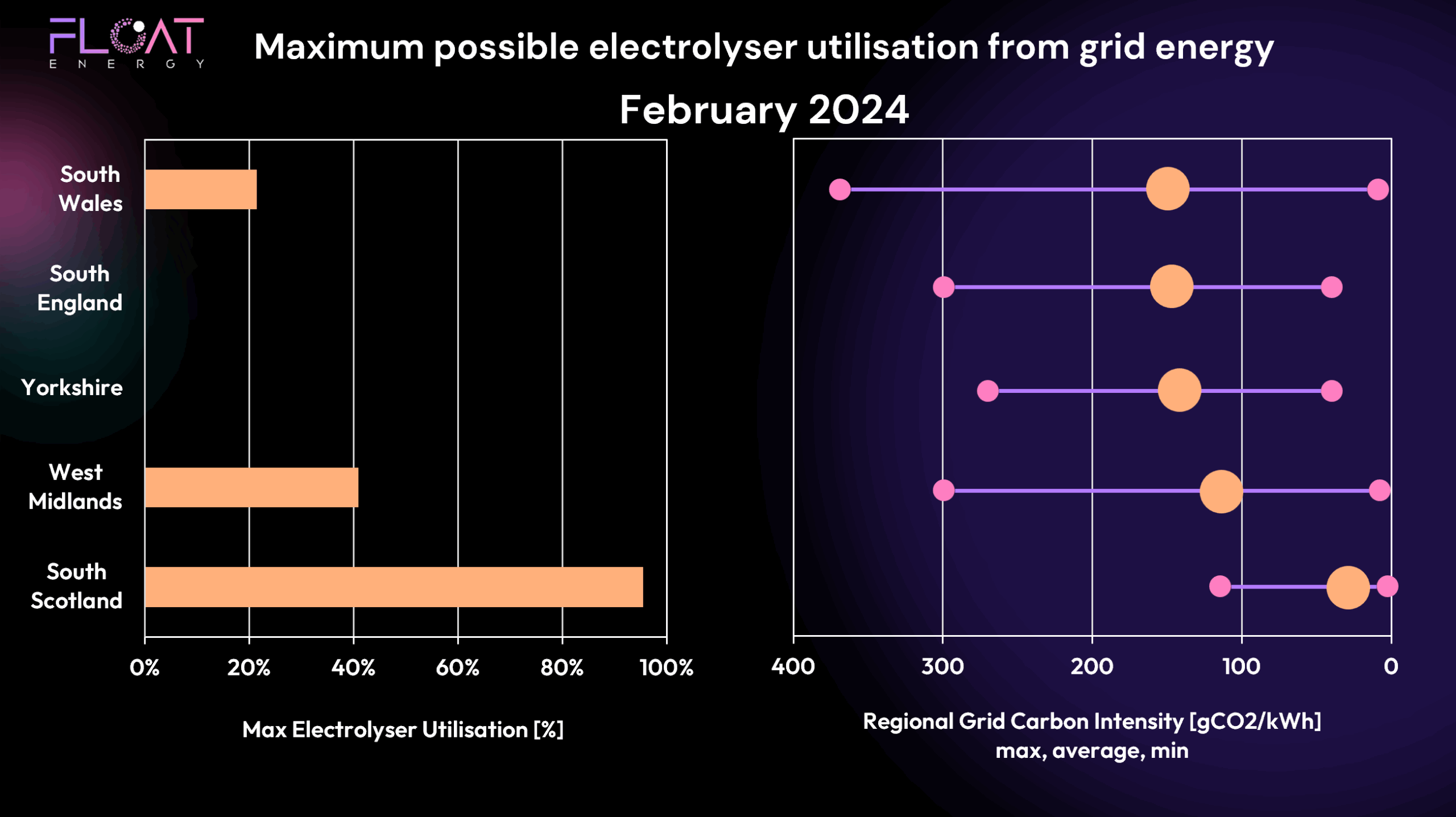

Carbon compliance is easy in some regions, harder in others.

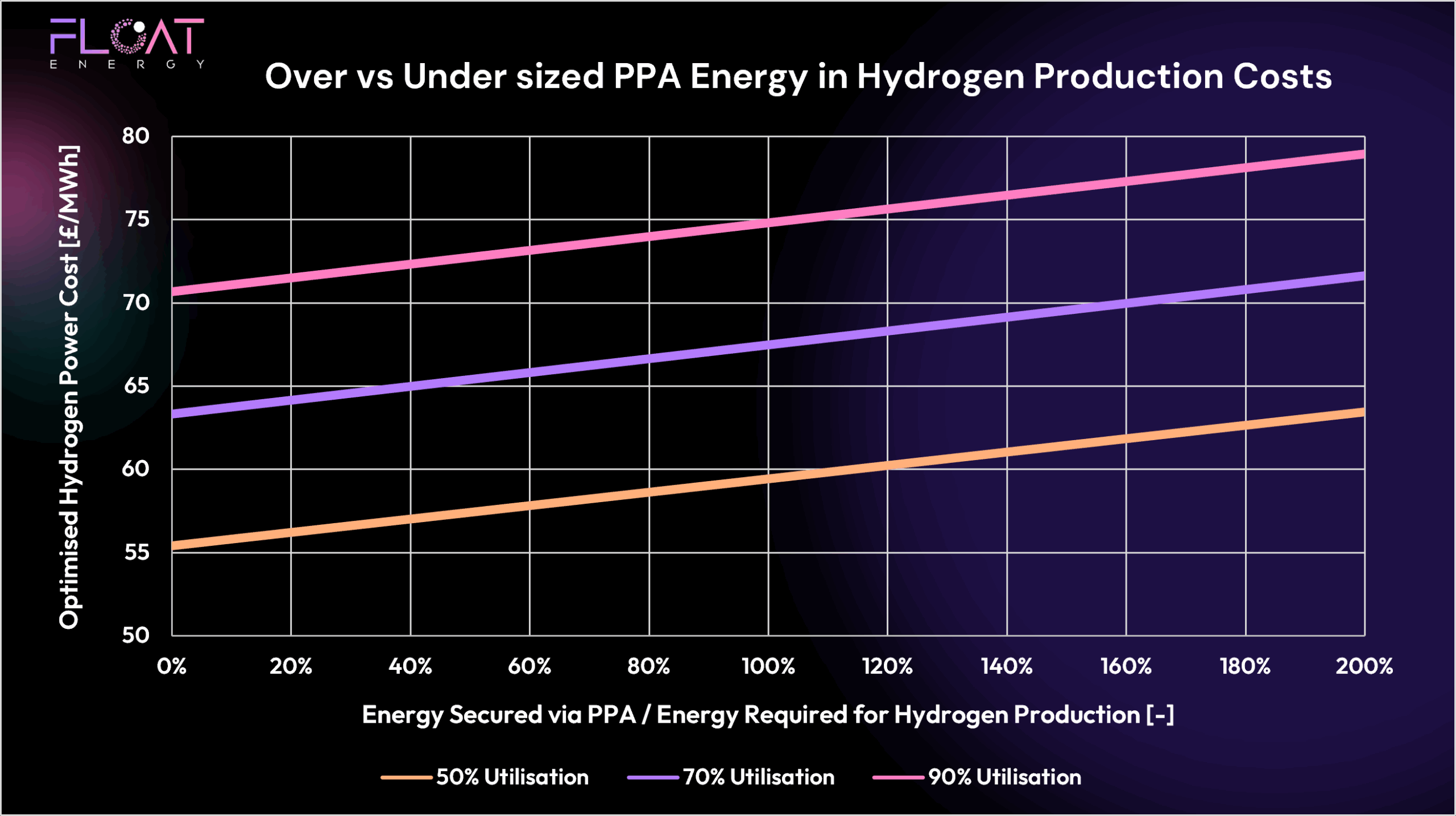

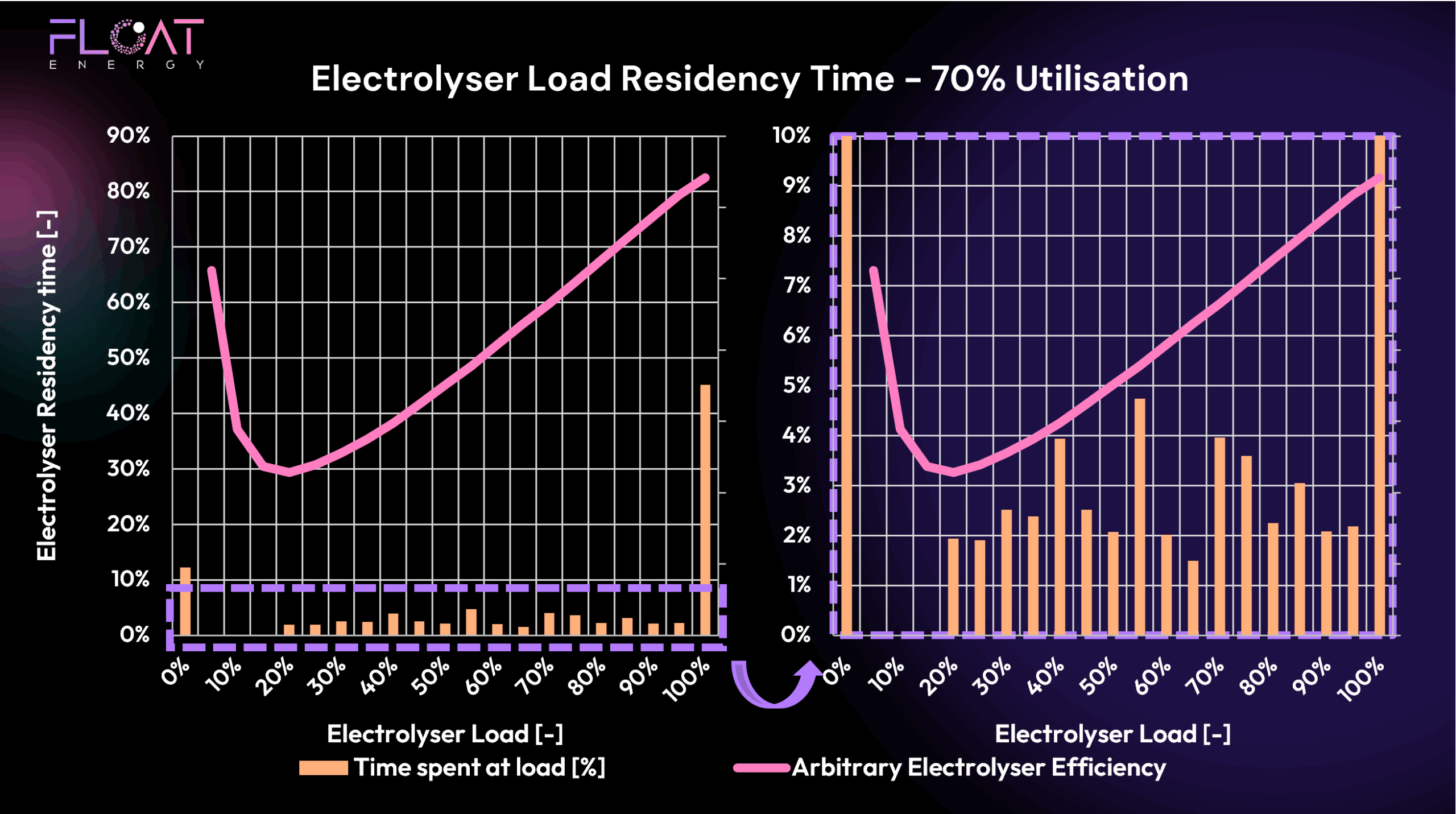

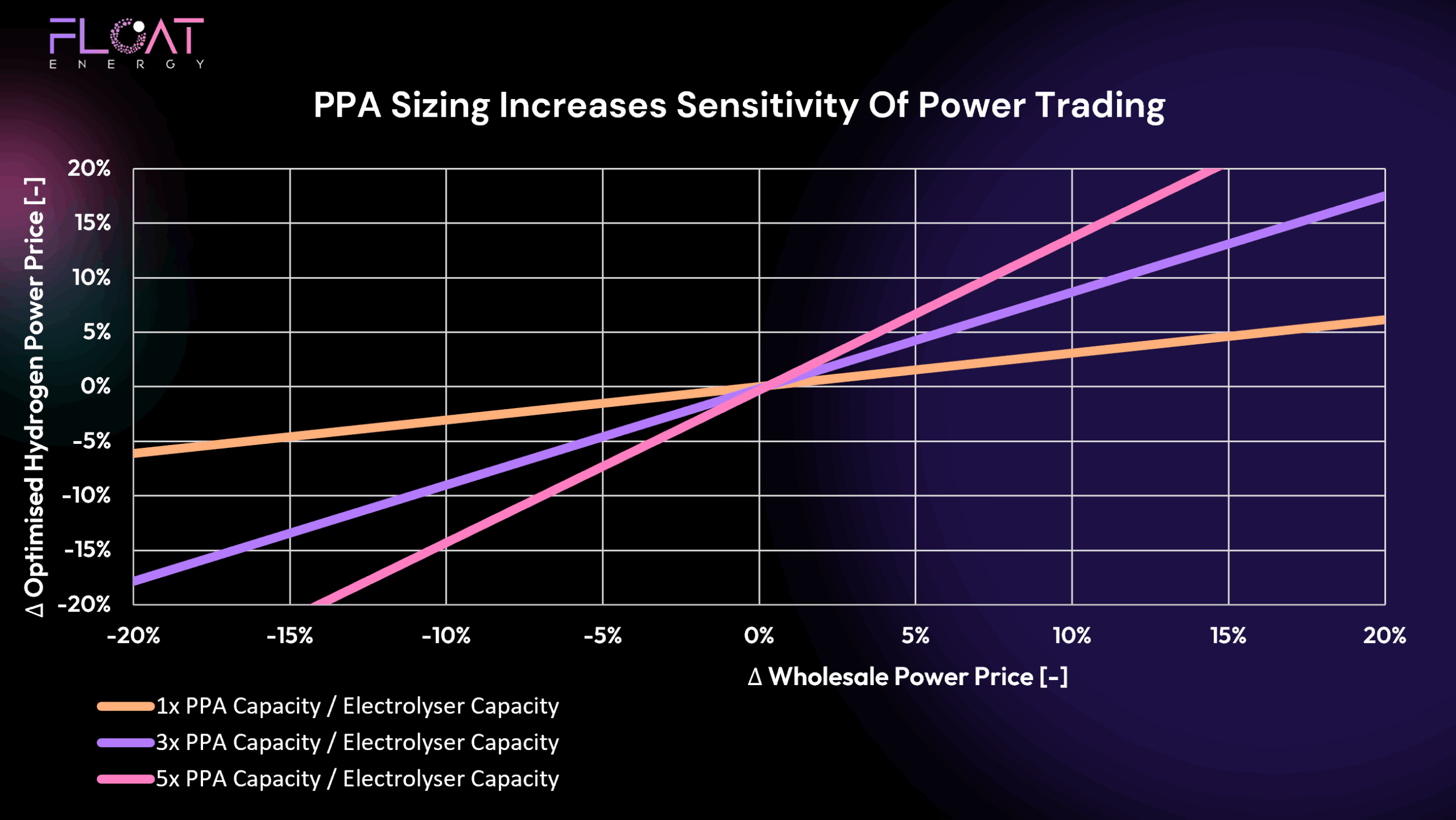

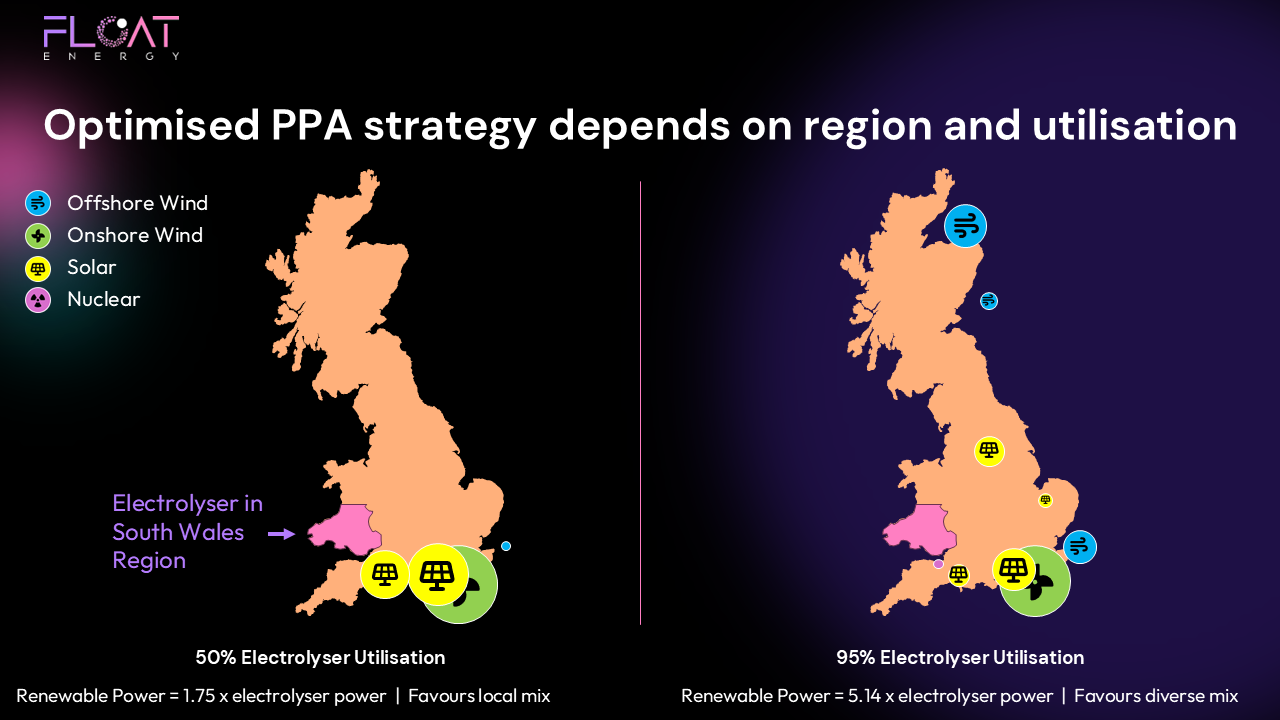

During higher-carbon periods/regions, smart scheduling keeps production below LCHS limits, giving you flexibility to operate on wholesale markets. Where PPAs are required to bolster the low carbon credentials of a plant, FLOAT is able to optimise the sizing and trading of this energy source.

Flexibility beats rigidity.

Fixed PPAs may provide bankability but they also lock in costs. FLOAT’s optimiser balances arbitrage between PPA price and wholesale market price to deliver the lowest-cost, compliant production.

Looking Ahead

With February continuing many of January’s trends — volatile markets, high balancing costs, and fragile supply — we’ll report next month on how FLOAT’s optimiser continues to safeguard hydrogen producers from these risks.

Key Takeaways for January 2025

✅ FLOAT Optimiser delivered a controlled, compliant production strategy in a volatile market

✅ Maintained CO₂ compliance

✅ Protected producers from extreme price volatility through real-time electrolyser scheduling

Ready to Strengthen Your Hydrogen Project?

If your hydrogen project is seeking to reduce exposure to volatile energy markets, maintain compliance, and protect bankability, speak to the FLOAT team today. Our optimisation service provides the insight, flexibility, and upside your project needs to thrive in uncertain markets.