Finding the Sweet Spot

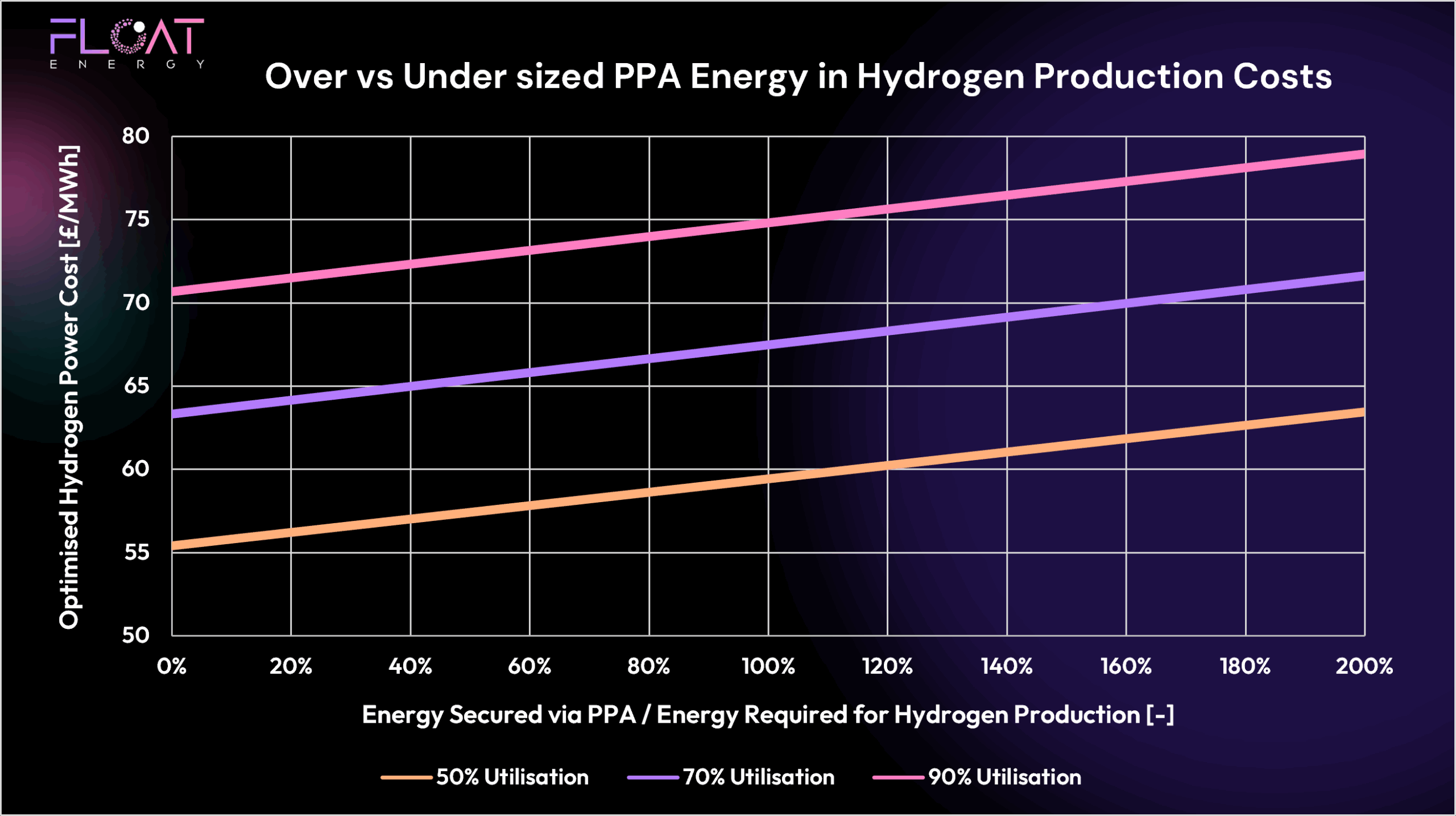

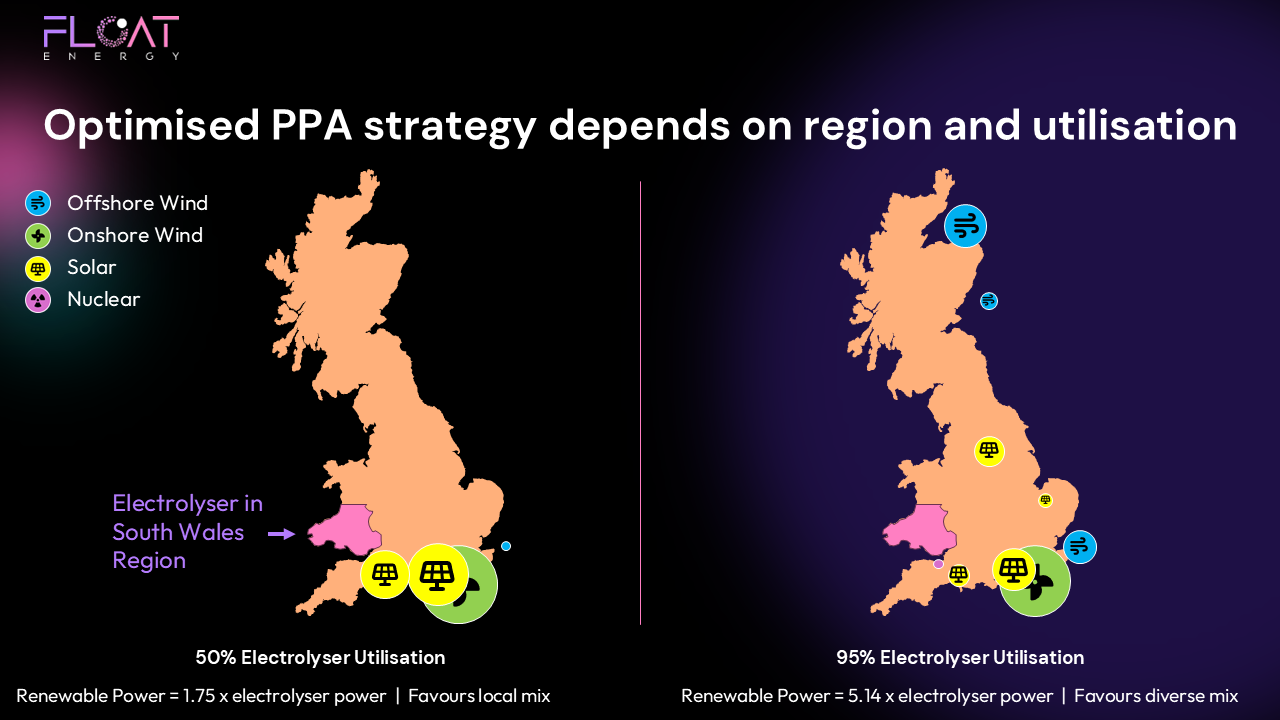

When planning a hydrogen project, every producer wants the lowest possible PPA price. But how much does PPA price actually affect the final hydrogen price? And how do you balance the upside from cheap renewable PPAs with the risk of over-committing to long-term contracts? We looked at the PPA sizes required to achieve carbon compliance in our last blog. clearly PPA price plays a role in hydrogen price but what’s the sensitivity?

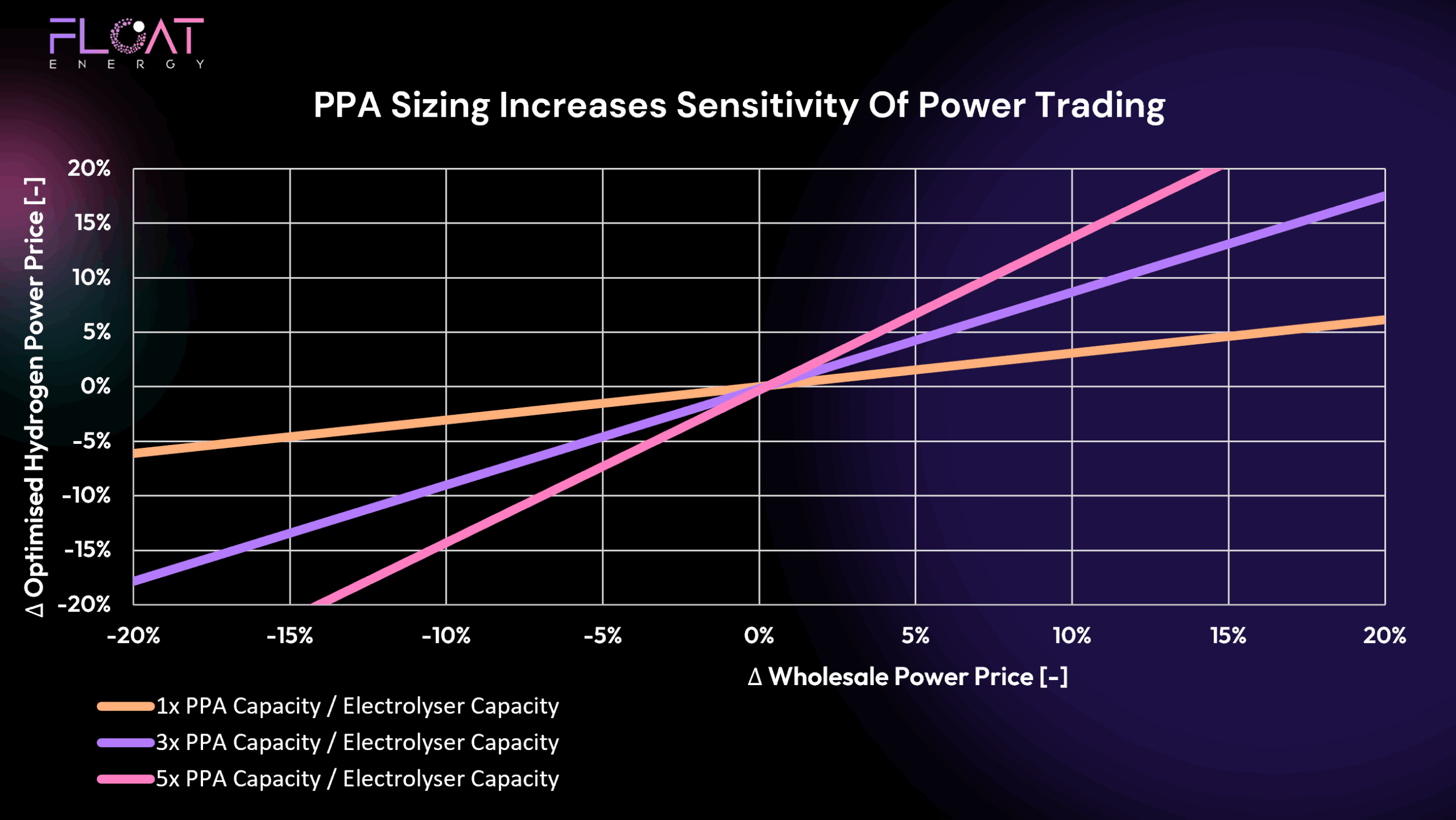

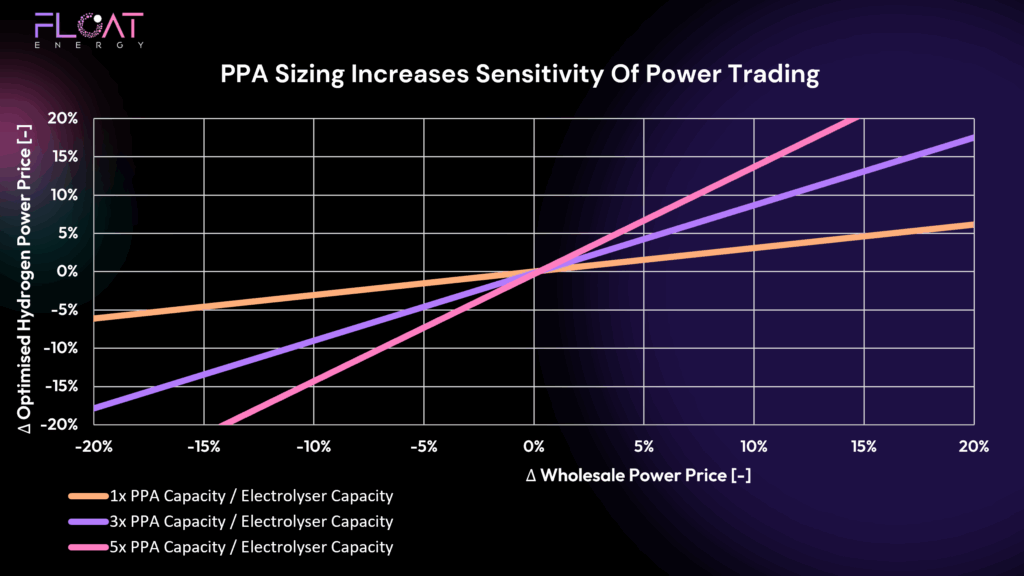

We ran simulations using our optimiser to explore how the effective hydrogen power price changes with varying PPA prices over a typical year (2024). We also tested different PPA sizes relative to electrolyser capacity to see how sensitive hydrogen pricing becomes when more PPA capacity is added.

A Misconception About Low-Cost PPAs

A common assumption is that if your PPA price is below the average wholesale price, you’ll be ‘in the money’ and able to sell energy at a profit. Unfortunately, this isn’t necessarily true.

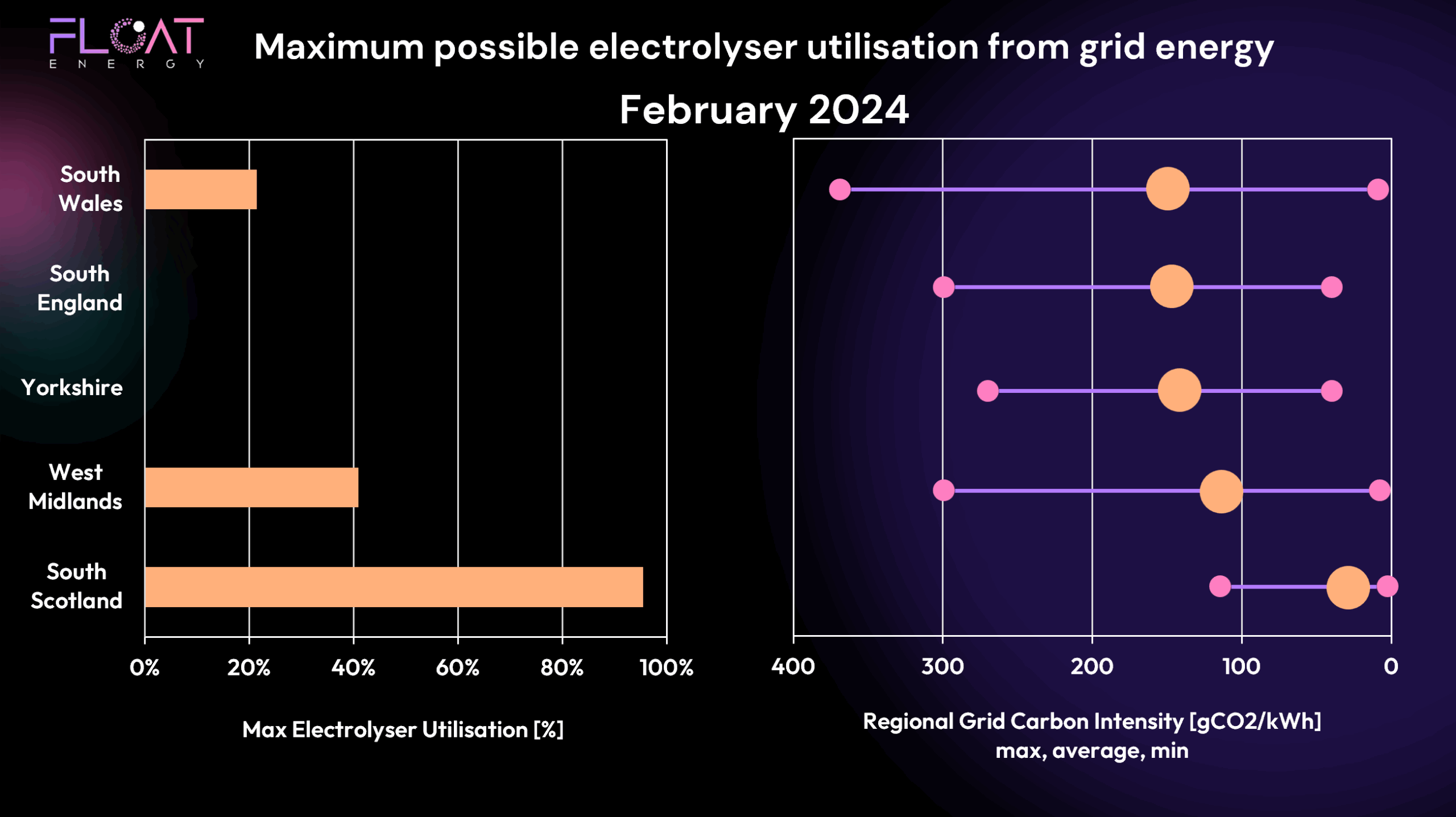

Due to cannibalisation, power prices often plunge when renewable generation peaks—when the sun is shining or the wind is blowing strongly, everyone is producing power at the same time. The times when your PPA is generating don’t line up neatly with average wholesale prices.

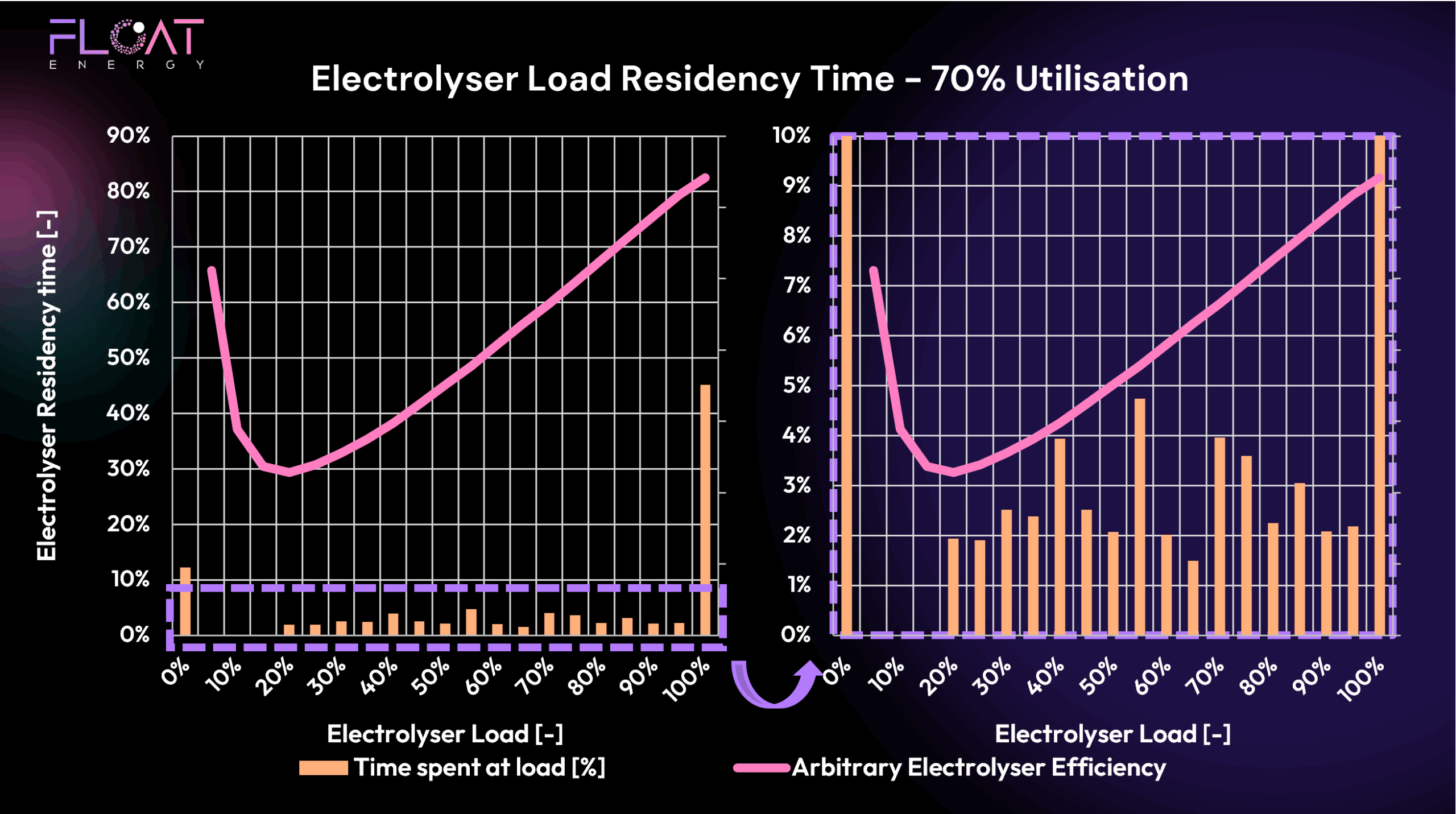

In reality, profitability depends on whether your PPA price is below a threshold price that reflects the hourly swings in the wholesale market and the characteristics of the hedge (which in our case is a hydrogen plant). Our ‘hedge’ only works when the electrolyser is running – and how often it runs depends on utilisation, storage capacity, and offtake profiles. The threshold price is therefore different for every project, depending on its unique operating conditions.

The Threshold Price – A Key Insight

Our results show that, for a given plant and generator location, all scenarios intersect at a single point – the threshold price. This price doesn’t depend on whether you have 1x, 3x, or 5x PPA capacity.

However, this common intersection won’t exist if you’re contracting with generators in different locations. Regional generation profiles don’t perfectly align, so stacking multiple PPAs from diverse sources creates a more complex interaction between price, generation, and hydrogen cost.

Why More PPA Means More Sensitivity

As shown in the graph, larger PPA sizes increase the sensitivity of the hydrogen price to wholesale market fluctuations. For example:

- 1x PPA capacity results in a relatively flat response – hydrogen pricing is more stable.

- 5x PPA capacity swings the hydrogen price sharply up or down as wholesale prices change.

This volatility can make your hydrogen project less bankable. Investors prefer projects with predictable costs, not those heavily exposed to trading outcomes.

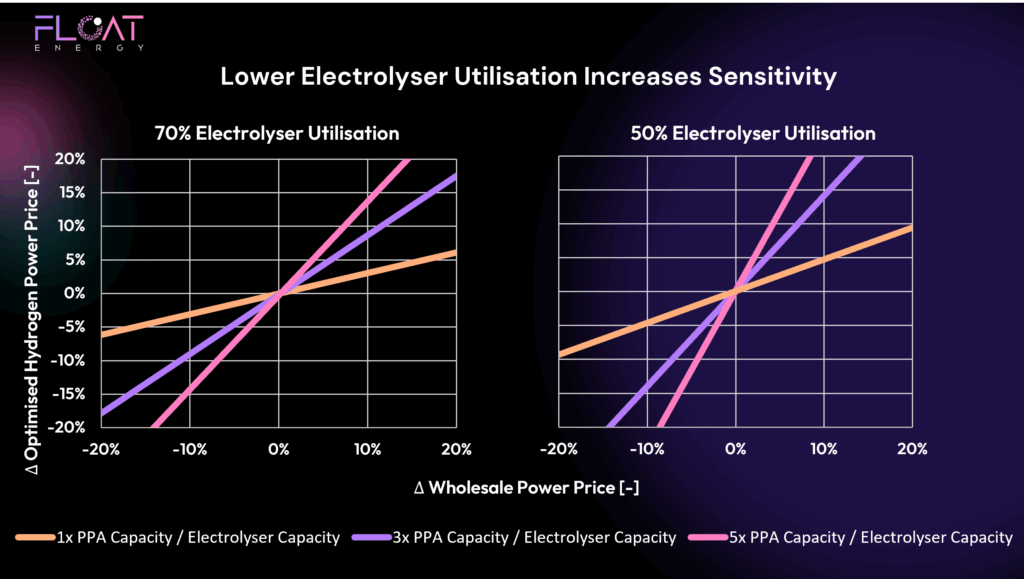

Utilisation Matters Too

We also tested a different electrolyser utilisation rate – 50%. The lower the utilisation, the more sensitive the result (it’s the same as increasing the PPA/electrolyser power ratio).

But there are practical challenges here. It’s very difficult to build a renewable portfolio with a capacity factor above 60%. Even if you have 5x the electrolyser capacity in contracted PPAs, you won’t be able to “sleeve” all of that generation to the electrolyser. At times, you’ll still be selling surplus power at market prices, which introduces trading risk and price volatility.

Finding the Sweet Spot – Why Optimisation Is Critical

PPA price is clearly critical, but sizing is just as important. Too little PPA, and you’re forced to buy expensive grid energy. Too much PPA, and you’re stuck selling your excess energy back to the grid—often at a loss.

This is where FLOAT’s real-time optimiser delivers value. It dynamically manages the interaction between your electrolyser dispatch schedule and renewable generation forecasts to ensure the lowest overall energy cost while maximising optimisation revenues from trading and off-peak operations.

Conclusion – The Role of Optimisation

PPA pricing directly impacts hydrogen costs, but the relationship is not linear. Oversizing PPAs increases risk, while undersizing leaves you exposed to grid volatility.

In our next blog, we’ll explore how to size a PPA given everything we’ve learnt so far. Ideally we want to size the PPA to fix energy costs, ensure carbon compliance, and still leave room for optimisation revenue.