In our previous blog, we explained how the FLOAT Optimiser works – integrating market prices, renewable forecasts, and plant flexibility to minimise hydrogen production costs. Let’s look back to 2024 to see how the optimiser performed in practice and an example of the savings your project could make against the wholesale energy price.

Efficient management of volatility

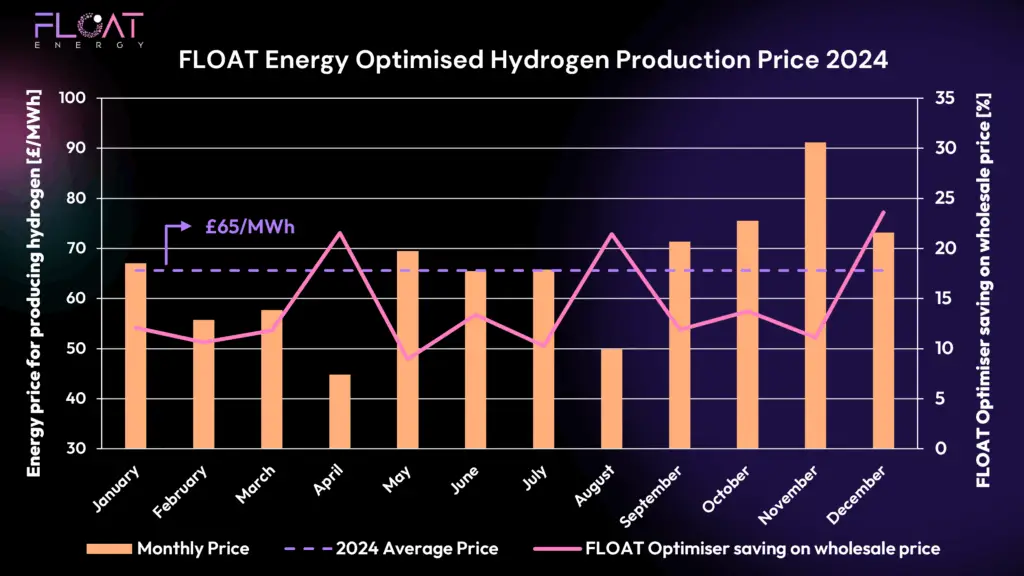

The chart below shows the monthly energy price for producing hydrogen across 2024 using FLOAT’s optimisation model. The orange bars represent the average monthly production price (£/MWh), while the pink line shows the percentage saving achieved by the optimiser relative to wholesale market prices. The dashed purple line marks the 2024 average production cost of £65/MWh.

Key Highlights from 2024

🔹 April and August – Capitalising on Negative Prices

April and August experienced periods of low and negative electricity prices. The optimiser was able to capitalise on these events, scheduling production during the cheapest periods to deliver the lowest monthly hydrogen production costs of the year.

🔹 November – Mitigating High Price Spikes

November’s wholesale power market saw extreme price spikes exceeding £300/MWh, several times higher than the annual average. Despite this volatility, the optimiser limited the increase in hydrogen production costs to a less than 40% rise above the annual average price, demonstrating its ability to shield hydrogen producers from the worst market impacts.

🔹 Consistent Savings Across the Year

The optimiser consistently delivered monthly savings of up to 23% relative to wholesale market prices, ensuring stable and predictable production costs in an otherwise unpredictable market.

Carbon Intensity Insights: Delivering Compliant Hydrogen Without PPAs

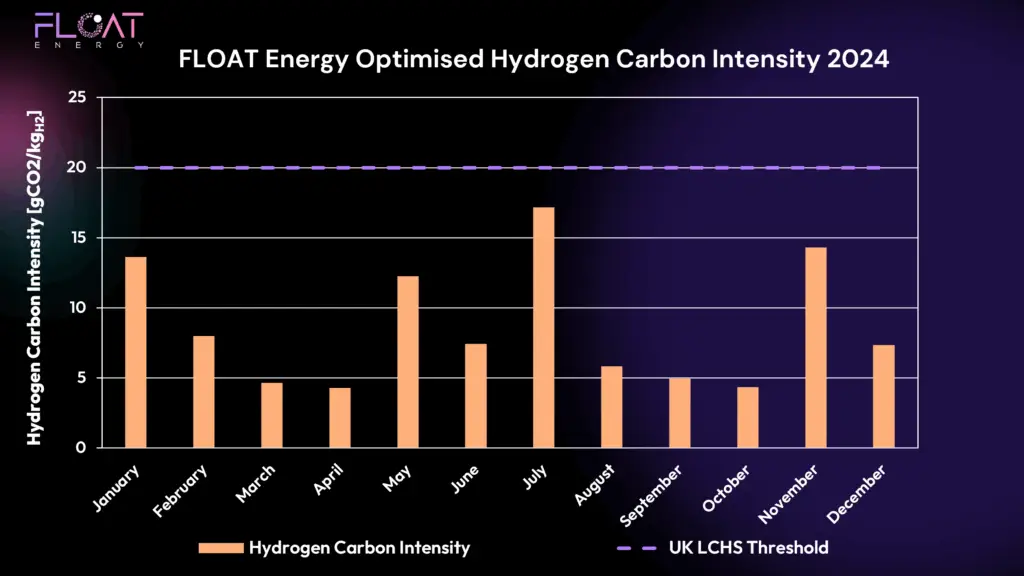

Alongside cost optimisation, we analysed the carbon intensity of hydrogen produced each month in 2024.

The results shown here use Scotland’s grid carbon intensity as a base. Across the year, the grid carbon intensity remained consistently low due to its high proportion of renewable generation. As a result, hydrogen production using FLOAT’s optimiser achieved CO₂ intensities well below the UK Low Carbon Hydrogen Standard (LCHS) threshold of 20 gCO₂/MJH2

This has significant strategic implications:

No Production Constraints Required:

- The optimiser was able to run production flexibly for cost without needing to restrict output to meet carbon compliance, unlocking operational freedom and maximising economic returns.

PPAs Not Always Necessary:

- While long-term PPAs are often assumed to be essential for compliance, our analysis shows that in regions like Scotland, grid electricity alone can deliver compliant hydrogen at a lower cost.

- This is particularly important given that The latest AR6 allocation round CFD prices for renewables were above average grid prices, increasing the cost of hydrogen production if PPAs are used purely for compliance rather than price security.

Why Does This Matter for Hydrogen Producers?

For hydrogen producers, these results demonstrate that FLOAT’s optimiser:

✅ Reduces production costs substantially

✅ Maintains compliance with the LCHS

✅ Provides resilience against extreme market volatility

✅ Can improve project bankability and competitiveness

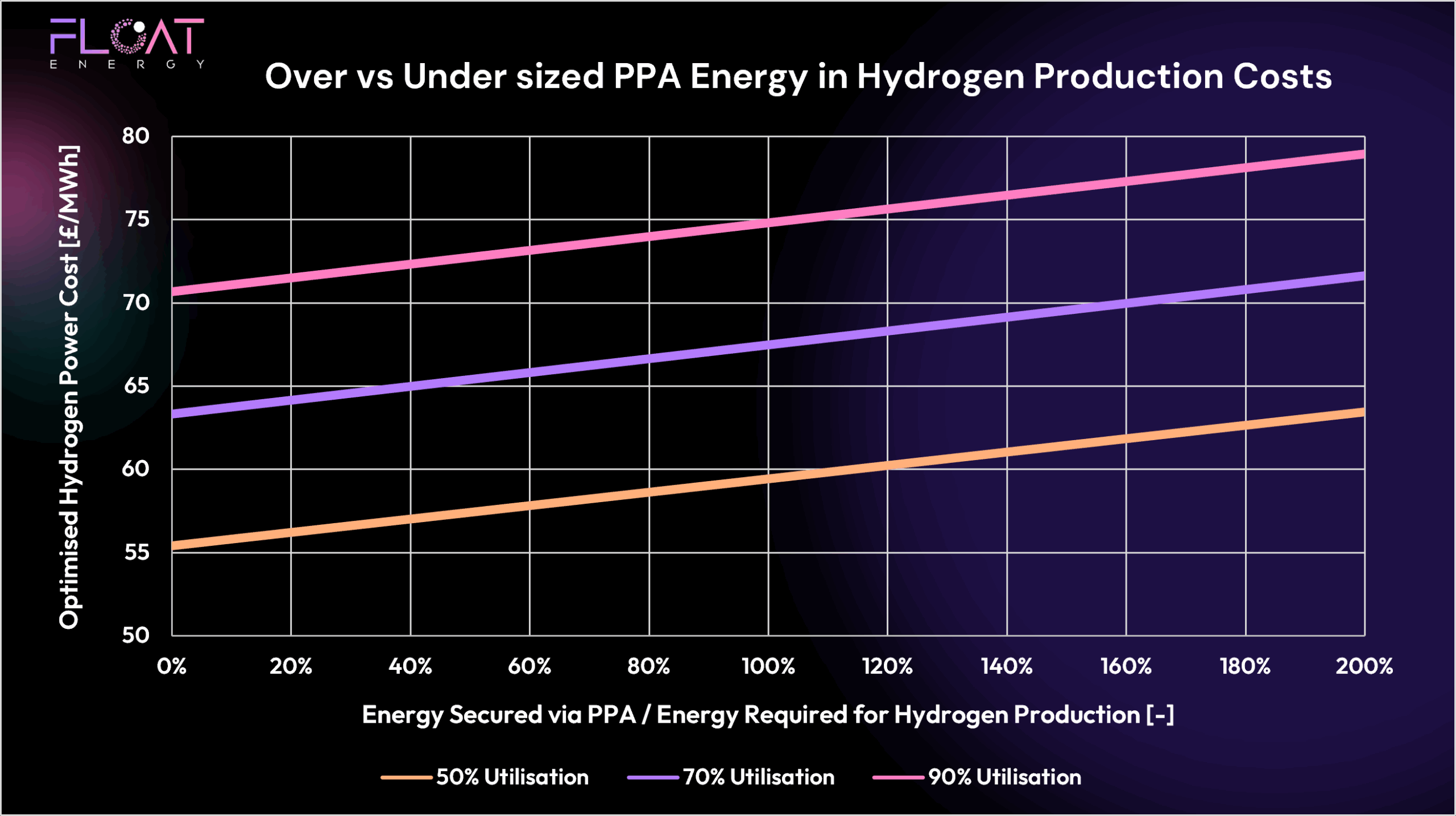

However, there is an important strategic question for producers to consider. Let’s revisit the point around using PPA’s in your hydrogen project:

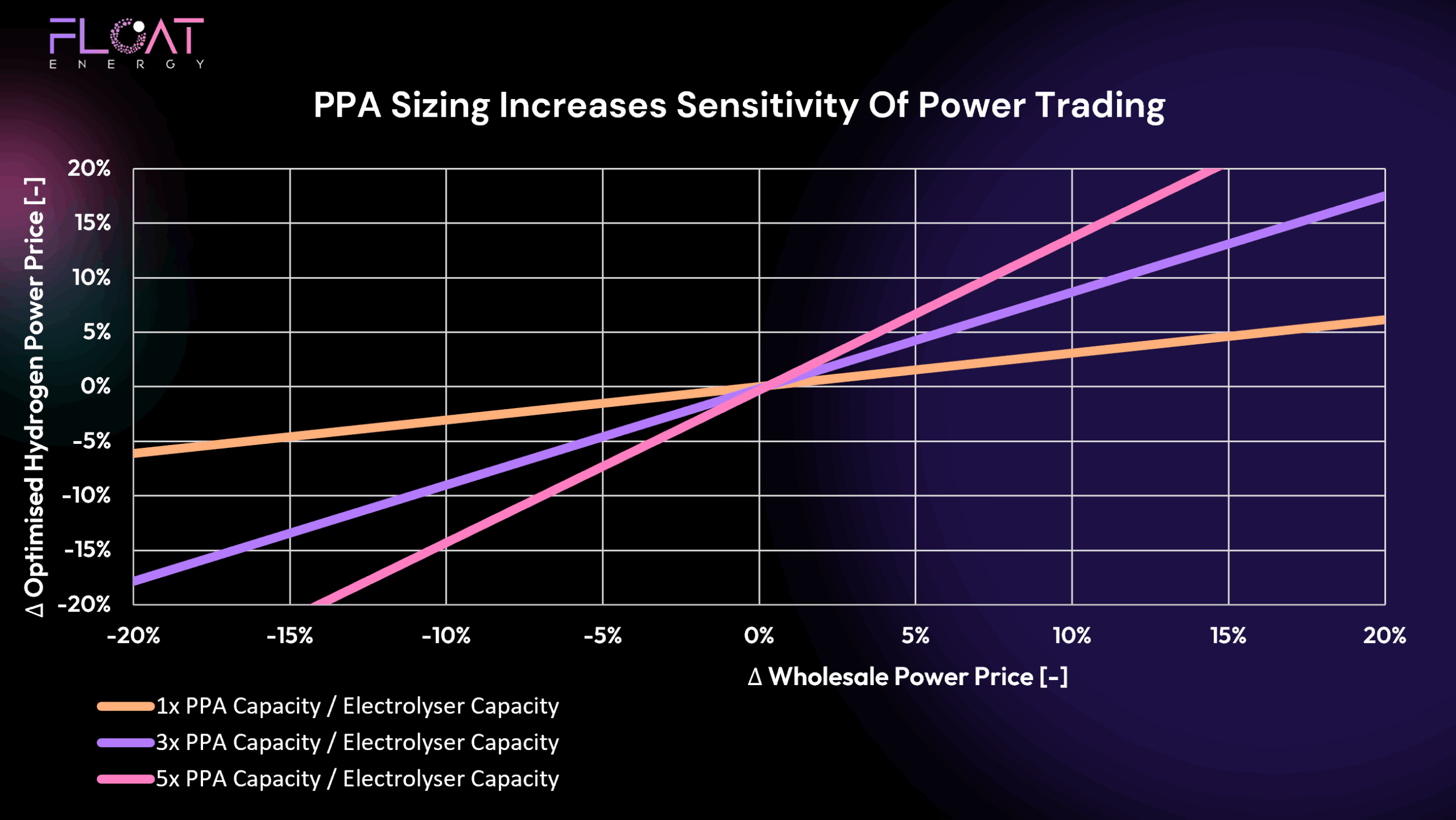

PPAs are currently priced well above grid averages, as seen in the latest Allocation Round 6 results. While PPAs can provide security of supply and improve bankability by offering long-term price certainty, relying exclusively on them could lock in costs above what the grid would average over time.

This raises a key optimisation challenge:

How can hydrogen producers balance the security and bankability benefits of PPAs with maximising access to cheap grid energy when it is available?

At FLOAT, we believe the solution lies in smartly integrating PPAs and wholesale energy procurement using optimisation. This ensures compliance, security, and lowest-cost production. Speak to our team to see how we can help your project.

Coming Soon: Exploring PPA Strategies

In our upcoming posts, we’ll dive deeper into:

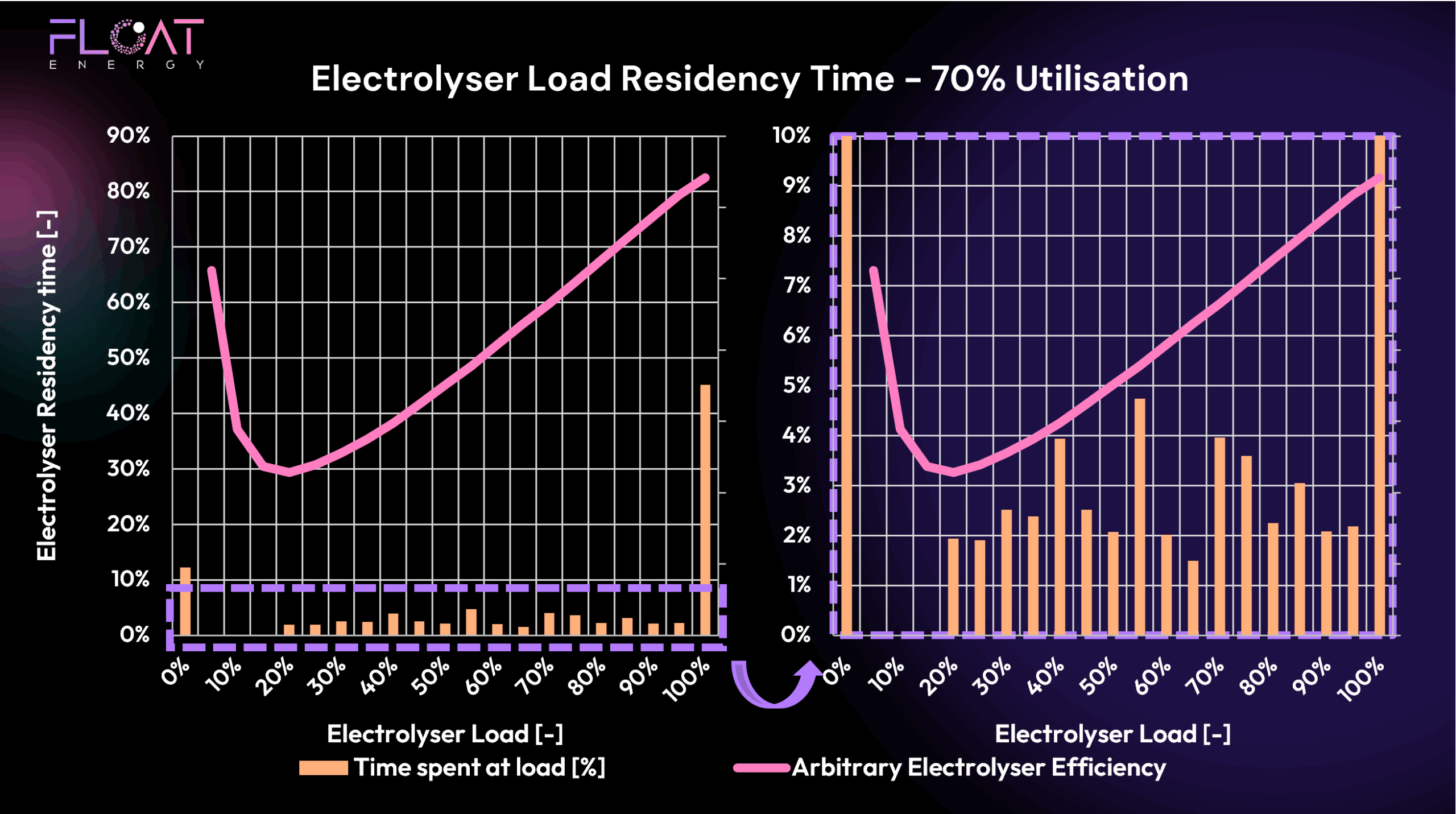

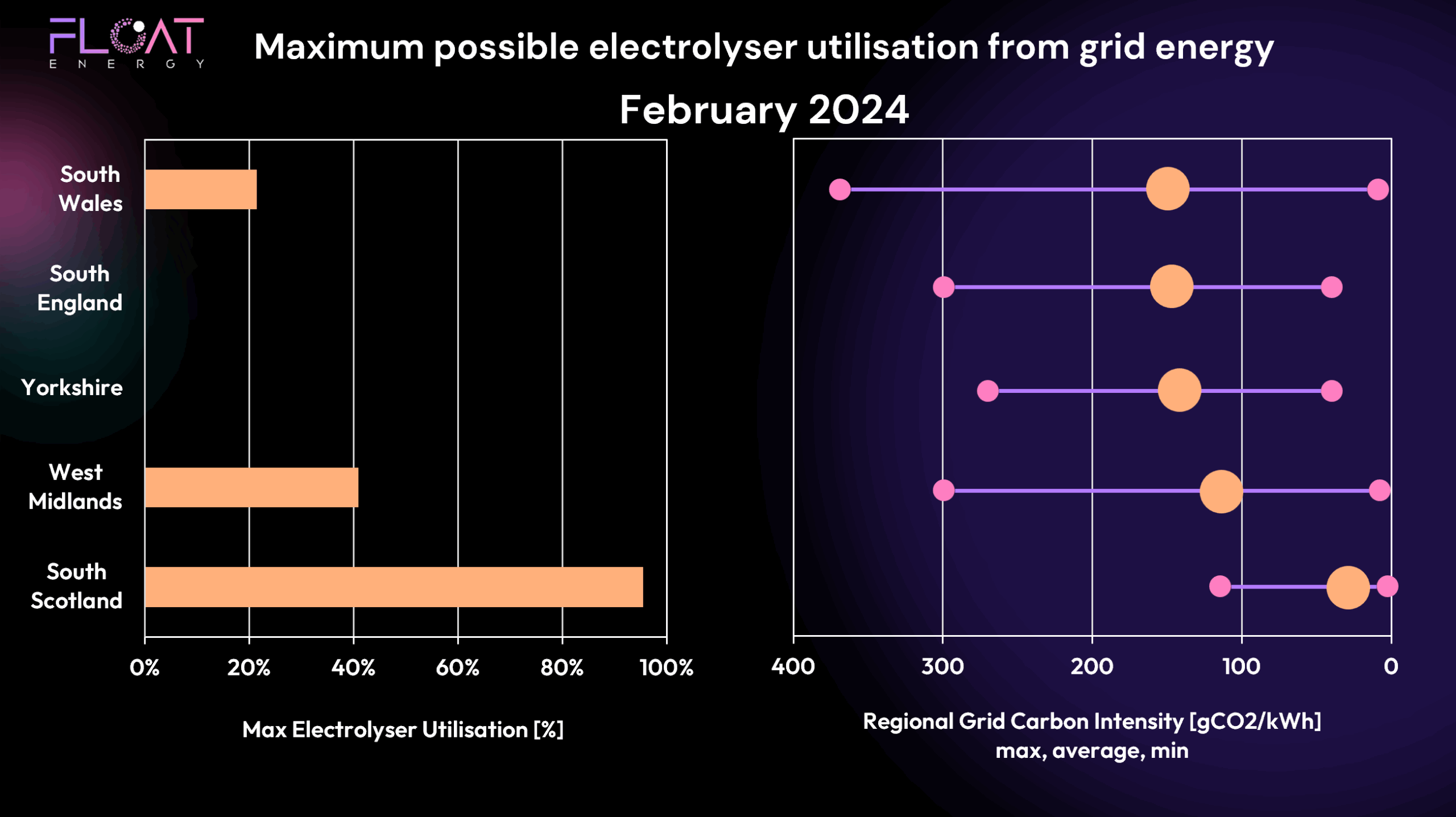

- Regional grid carbon intensity and their impact on electrolyser utilisation

- What size PPA does your hydrogen project need?

- What are the opportunities and risks by incorporating PPA’s to your hydrogen project?

Stay tuned as we unpack these topics to support your operational and commercial decision-making in 2025.

Want to optimise your hydrogen production costs?

Contact us to discuss how FLOAT can support your project’s performance and strengthen your commercial strategy.